XRP Price Prediction: Up Around 14%, Targeting Key $4 Resistance, Is $1,000 a Dream or a Long-Term Trend?

XRP Eyes a Break Above $4

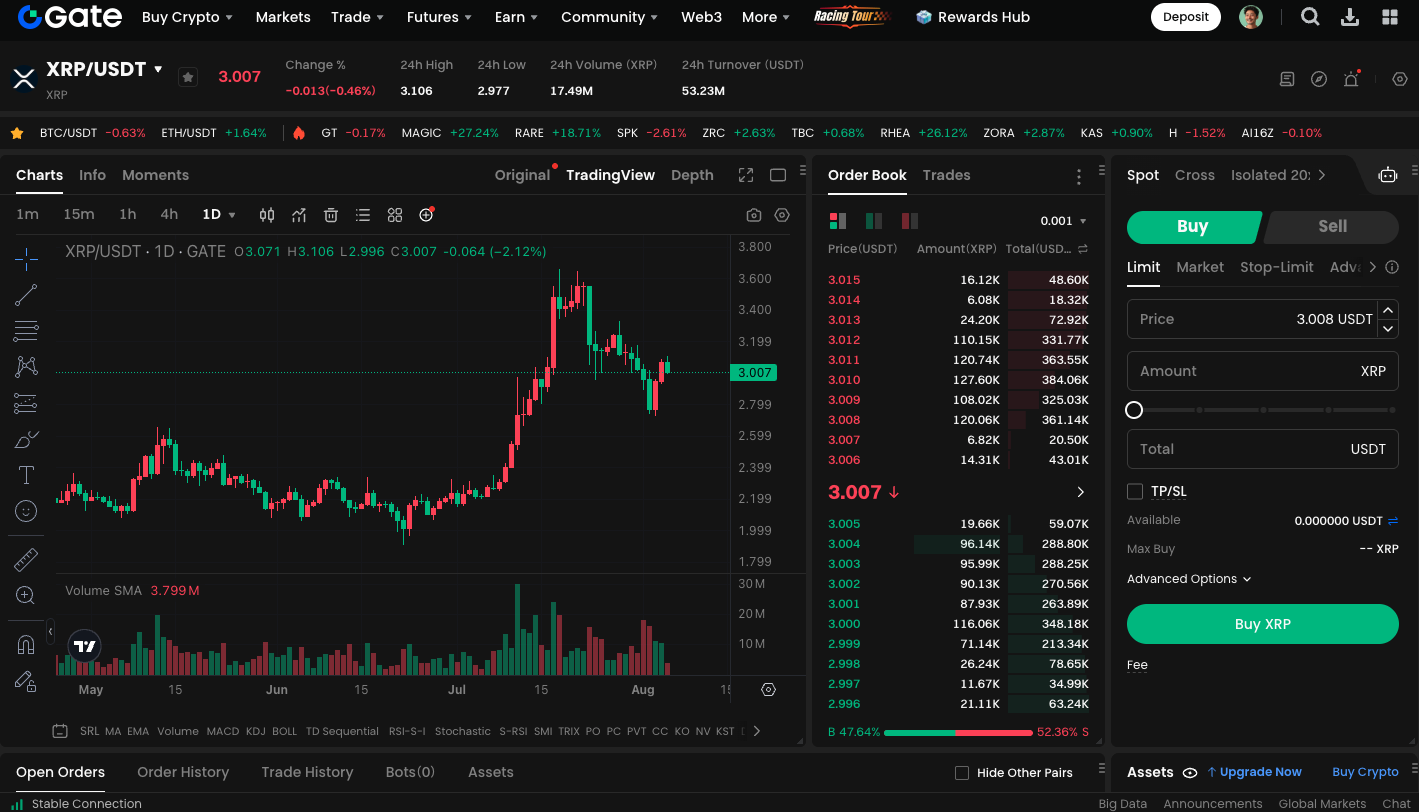

Since breaking out of its prolonged consolidation phase in early July 2025, XRP has seen a rapid rally driven by renewed market enthusiasm and capital inflows. Industry observers note that the SEC approved the ProShares XRP ETF, which has been a major catalyst in this breakout. This approval sent the token surging to $3.65 in mid-July and propelled its market capitalization past $200 billion. In the near term, $4 is the point of focus. If XRP can hold above this level, it could pave the way for a new upward price channel.

Long-Term Value Outlook for XRP

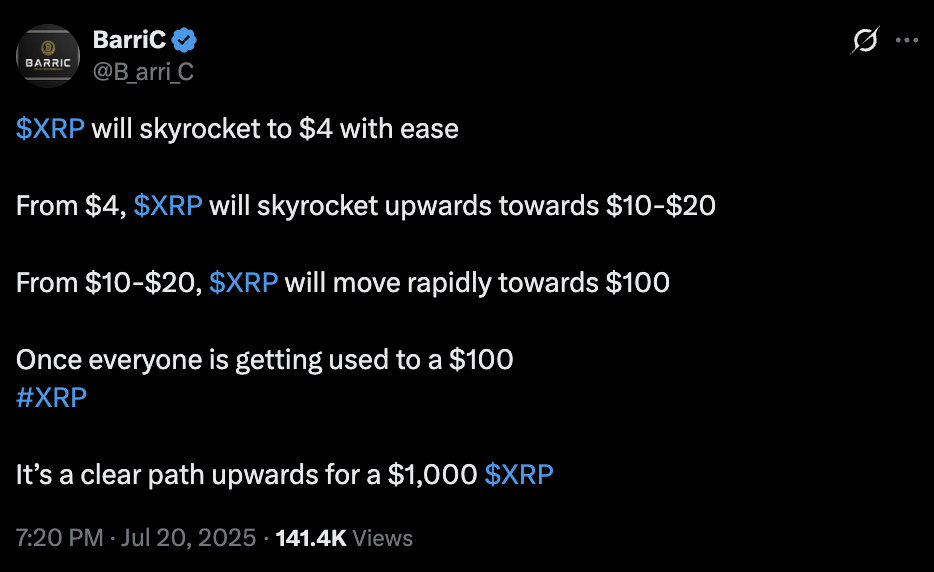

Veteran crypto analyst BarriC recently outlined a tiered value roadmap on social platform X, setting an ultimate target of $1,000 for XRP. He argues that XRP’s fundamental value lies in its potential to become the standard for cross-border payments and financial infrastructure. Broad adoption of XRP by global banks would shift demand from transactional to structural. This shift would provide the foundation for much higher prices. BarriC describes the three-stage path as follows:

- Stage 1: $4 — XRP will test resistance and confirm the upward trend.

- Stage 2: Reaching prices between $10 and $20 — This phase may trigger widespread bullish sentiment.

- Ultimate Stage: Surpassing $100, aiming for $1,000 — This would require mass institutional adoption and a central position within global payments infrastructure.

(Source: B_arri_C)

The market remains split on whether a $1,000 XRP is realistic. Hitting that milestone would require XRP’s market capitalization to exceed $50 trillion—well above the total value of any single global company or asset. In today’s market, this remains an extremely ambitious scenario.

Critical Short-Term Support and Risk Factors

To keep the bullish momentum going, XRP needs to hold the $3 support level and close above $4, establishing a new foundation for its upward move. If it fails to maintain these levels, it could drop back to the $2.5 range or even lower.

You can start trading XRP spot instantly at: https://www.gate.com/trade/XRP_USDT

Conclusion

While a $1,000 target remains highly aspirational, a move into the $10 to $20 range over the short to medium term is considered a realistic scenario by many investors.