BTC Price Prediction: Bitcoin Holds Around $114K, Next Stop $119K Rebound or $95K Correction?

BTC Market Overview

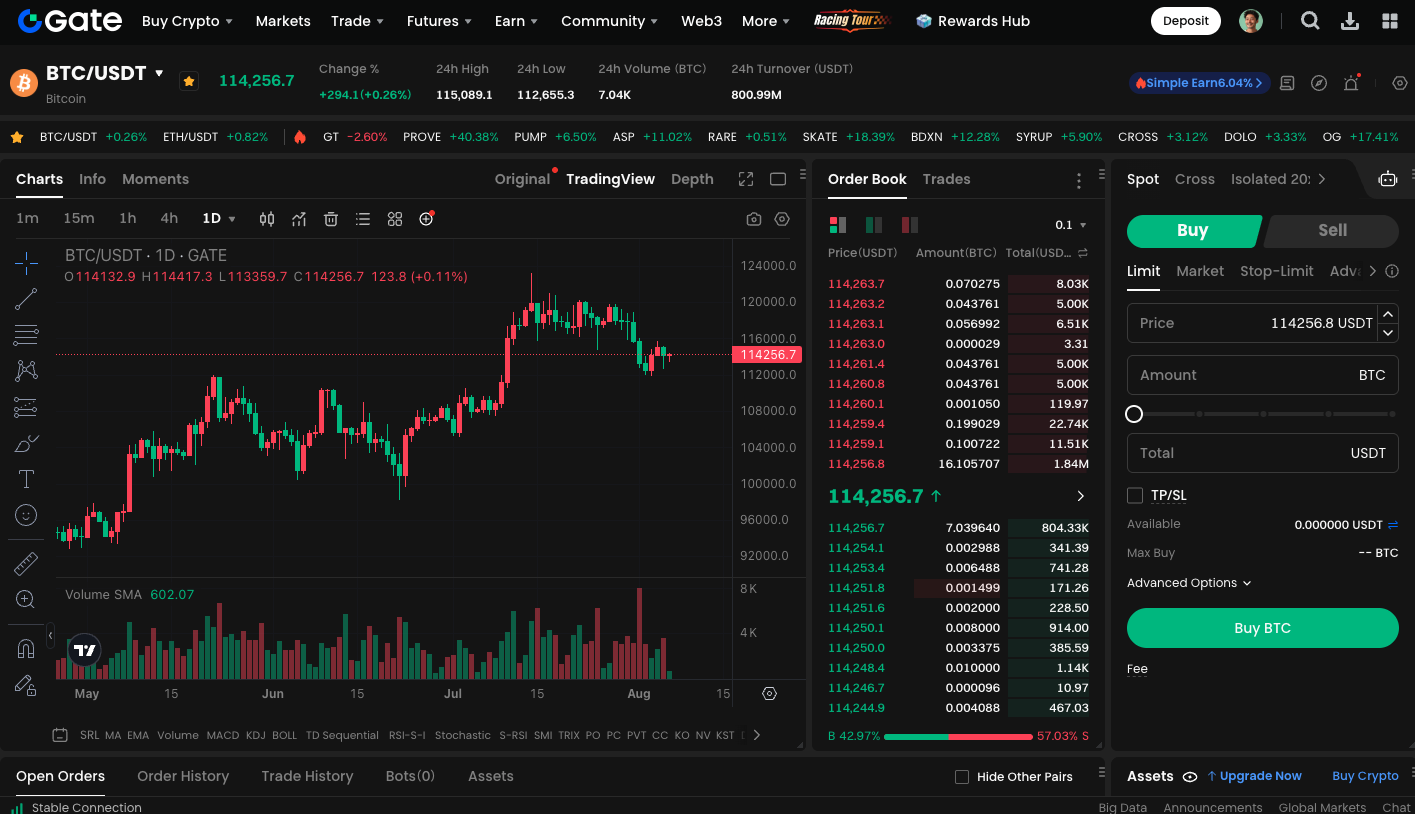

Following a period of intense volatility, Bitcoin (BTC) is now consolidating near $114,000. Market sentiment has grown more cautious, and BTC faces two potential paths: resuming its upward move to challenge $119,000 or pulling back to $95,000 to find renewed support.

Bull-Bear Divergence Widens

Multiple technical analysts note that the Relative Strength Index (RSI) is signaling very different outlooks across various timeframes. Well-known analyst Ali issued a warning: if Bitcoin repeats past behavior, a weekly RSI break below the 14-period moving average has previously led to corrections of 20% to 30%, which could drive the price back to $95,000.

(Source: ali_charts)

On the other hand, some analysts hold the opposite view. Sykodelic observed that the daily RSI is approaching lows observed during previous cycles, specifically at $98,000 and $76,000. If buyers return, bulls may have a strong opportunity to accumulate positions.

Key Support and Resistance Levels Identified

Currently, all eyes are on the $112,600 mark, which serves as a critical short-term support zone. If this support holds and technical indicators confirm bullish RSI divergence, BTC may initiate a new rally toward $119,000. If not, bears may regain control, pushing the price down toward the $95,000 support area and initiating a broader market correction. Most analysts agree that watching shifts in trading volume, moving averages, and daily closing levels is vital to identifying false breakouts or breakdowns.

Tom Lee Reaffirms $250,000 Target

Despite short-term market uncertainty, Fundstrat co-founder Tom Lee maintains his bullish outlook for Bitcoin. On a recent podcast, Lee stated that BTC could reach $200,000 or even $250,000 by year-end. He emphasized that persistent institutional inflows are a key indicator of market strength, and price advances often occur during periods of prevailing skepticism. Lee even projected that Bitcoin could ultimately reach $1,000,000.

Other institutions have turned somewhat more cautious. Bernstein and Standard Chartered have set a year-end 2025 BTC target at $200,000, while 10x Research has revised its target down to $160,000.

For spot trading opportunities, visit: https://www.gate.com/trade/BTC_USDT

Summary

Bitcoin is currently at a crossroads driven by technical factors and market sentiment. If the $112,600 support holds and bullish RSI divergence is confirmed, the price could potentially reach new highs above $119,000 in the second half of the year. However, a technical breakdown below this critical support may trigger a retest of $95,000 and further market consolidation. Over the longer term, while 2025 price targets vary among analysts, the consensus remains generally bullish. This outlook is contingent on continued structural capital inflows and major breakthrough events.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025