- Topic

12k Popularity

275k Popularity

8k Popularity

883 Popularity

709 Popularity

- Pin

- 💞 #Gate Square Qixi Celebration# 💞

Couples showcase love / Singles celebrate self-love — gifts for everyone this Qixi!

📅 Event Period

August 26 — August 31, 2025

✨ How to Participate

Romantic Teams 💑

Form a “Heartbeat Squad” with one friend and submit the registration form 👉 https://www.gate.com/questionnaire/7012

Post original content on Gate Square (images, videos, hand-drawn art, digital creations, or copywriting) featuring Qixi romance + Gate elements. Include the hashtag #GateSquareQixiCelebration#

The top 5 squads with the highest total posts will win a Valentine's Day Gift Box + $1 - 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

1️⃣ #TokenOfLove# | Festival Ticket Giveaway

Cheer for your idol on Gate Square! Pick your favorite star — HyunA, SUECO, DJ KAKA, or CLICK#15 — and post with SingerName + TokenOfLove hashtag to win one of 20 music festival tickets.

Details 👉 https://www.gate.com/post/status/13217654

2️⃣ #GateTravelSharingAmbassadors# | Share Your Journey, Win Rewards

Gate Travel is now live! Post with the hashtag and sha - 🎤 Cheer for Your Idol · Gate Takes You Straight to Token of Love! 🎶

Fam, head to Gate Square now and cheer for #TokenOfLove# — 20 music festival tickets are waiting for you! 🔥

HyunA / SUECO / DJ KAKA / CLICK#15 — Who are you most excited to see? Let’s cheer together!

📌 How to Join (the more ways you join, the higher your chance of winning!)

1️⃣ Interact with This Post

Like & Retweet + vote for your favorite artist

Comment: “I’m cheering for Token of Love on Gate Square!”

2️⃣ Post on Gate Square

Use hashtags: #ArtistName# + #TokenOfLove#

Post any content you like:

🎵 The song you want to he - ✈️ Gate Square | Gate Travel Sharing Event is Ongoing!

Post with #Gate Travel Sharing Ambassadors# on Square and win exclusive travel goodies! 💡

🌴 How to join:

1️⃣ Post on Square with the hashtag #Gate Travel Sharing Ambassadors#

2️⃣ You can:

Share the destination you most want to visit with Gate Travel (hidden gems or hot spots)

Tell your booking experience with Gate Travel (flights/hotels)

Drop money-saving/usage tips

Or write a light, fun Gate Travel story

📦 Prizes:

🏆 Top Ambassador (1): Gate Travel Camping Kit

🎖️ Popular Ambassadors (3): Gate Quick-Dry Travel Set

🎉 Lucky Participant

May Performance Review / June Strategic Portfolio | Strategy Report | Moneyクリ MoneyX Securities Investment Information and Money-Helpful Media

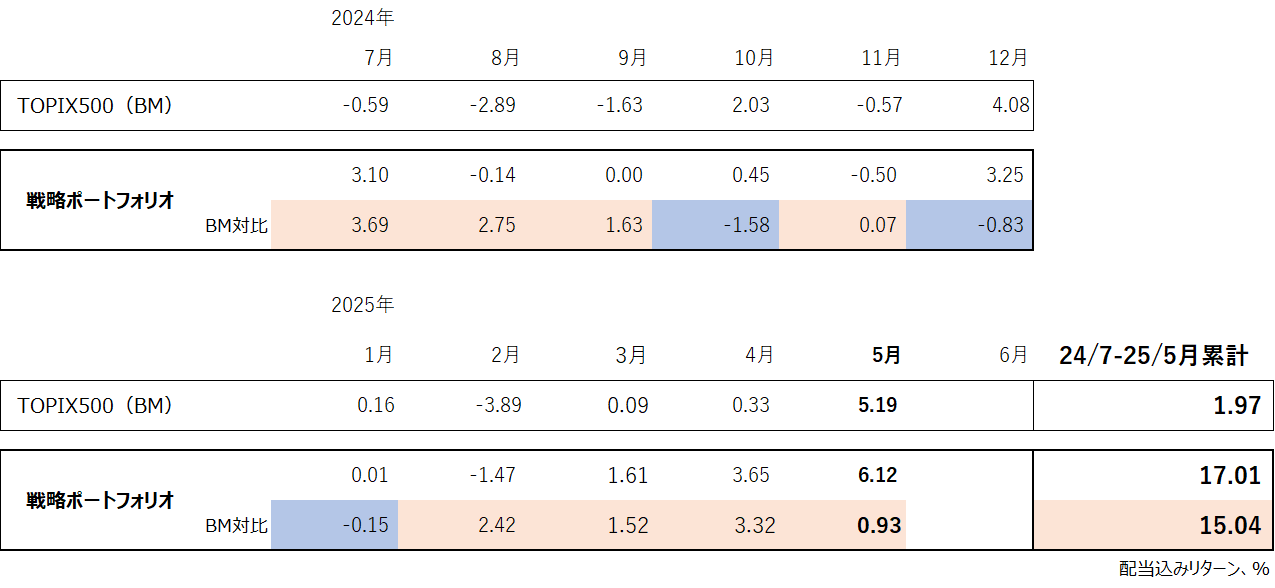

The cumulative performance since the start of operation is a 17% increase.

The strategic portfolio in May outperformed the benchmark by just under 1%. It has exceeded the benchmark for four consecutive months, and the cumulative performance since the start of operations has been a positive 17% over 11 months. The difference from the benchmark, which has a positive return of just under 2% during the same period, has reached an outperformance of 15%.

Table 1: Monthly and Cumulative Returns Since Inception Source: Created by the author based on QUICK data

In May, the Japanese stock market was strong, with the Nikkei average rising by 1,919 yen (5%) for the month. This increase in the Nikkei average was the largest since February 2024 (2,879 yen). Even in such a rising market, it was able to firmly outperform the benchmark. Previously, the portfolio's strong resistance to downside risks had been notable, but this time, it also demonstrated excellent ability to follow through on the upside.

Source: Created by the author based on QUICK data

In May, the Japanese stock market was strong, with the Nikkei average rising by 1,919 yen (5%) for the month. This increase in the Nikkei average was the largest since February 2024 (2,879 yen). Even in such a rising market, it was able to firmly outperform the benchmark. Previously, the portfolio's strong resistance to downside risks had been notable, but this time, it also demonstrated excellent ability to follow through on the upside.

As can be seen from the performance graph, this portfolio does not decline in bear markets and rises in line with or above the market in bull markets. The result of this has manifested in a performance of 15% outperformance over just under a year of management.

Graph: Performance Trends Source: Created by the author based on QUICK data

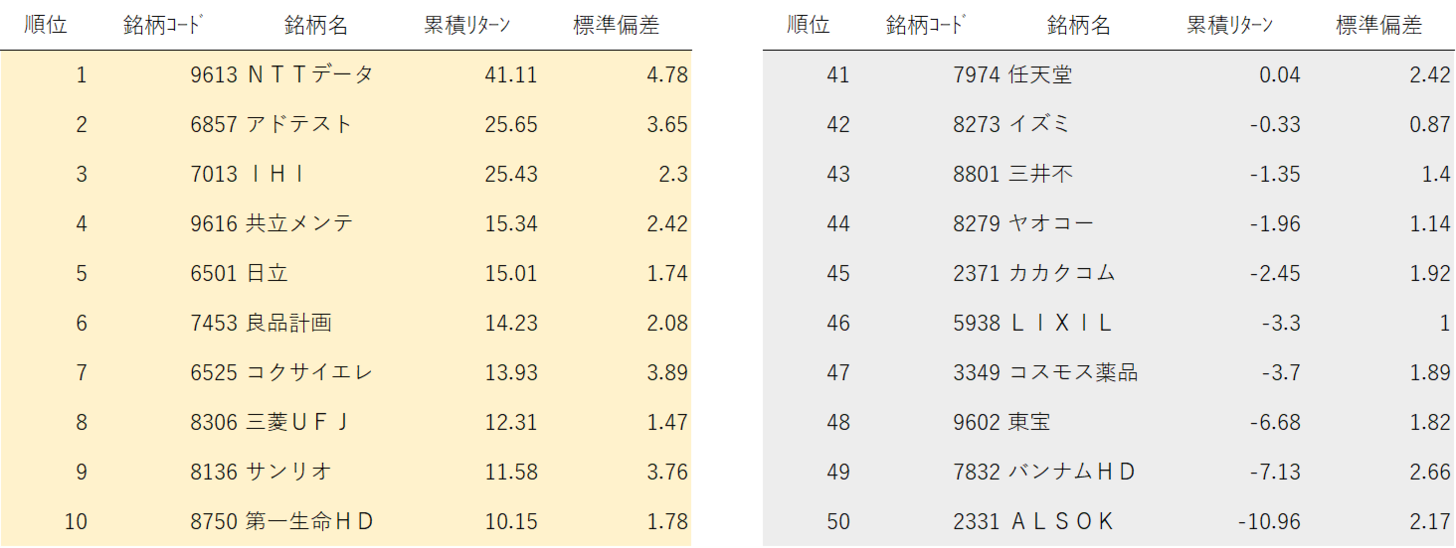

The top and bottom returns by brand for May are shown in Table 2.

Source: Created by the author based on QUICK data

The top and bottom returns by brand for May are shown in Table 2.

Table 2: Top and Bottom Returns by Asset Source: Created by the author based on QUICK data

Source: Created by the author based on QUICK data

Release of the June Strategic Portfolio

NTT Data (9613), which was the top performer in May, will be removed from the list as its complete acquisition by NTT (9432) has been announced. Sanrio (8136), which had a strong return ranking of 9th in May, will be temporarily excluded from the portfolio as its evaluation has been rising significantly recently. The same applies to Penta-Ocean Construction (1893), which experienced a surge due to good performance. Additionally, Yachiyo Bank (8359) will be replaced by Hokkoku Bank (8524). Shin-Etsu Chemical (4063), which is originally a core stock for long-term holding, will also be temporarily substituted by SUMCO (3436) this month. One angle to consider this month is the high dividends of companies reporting in June and December, such as AGC (5201) and Yamaha Motor (7272). However, the selection of stocks based on traditional human capital factors continues. The style of targeting alpha through multiple factor diversification/rotation is, needless to say, unchanged.

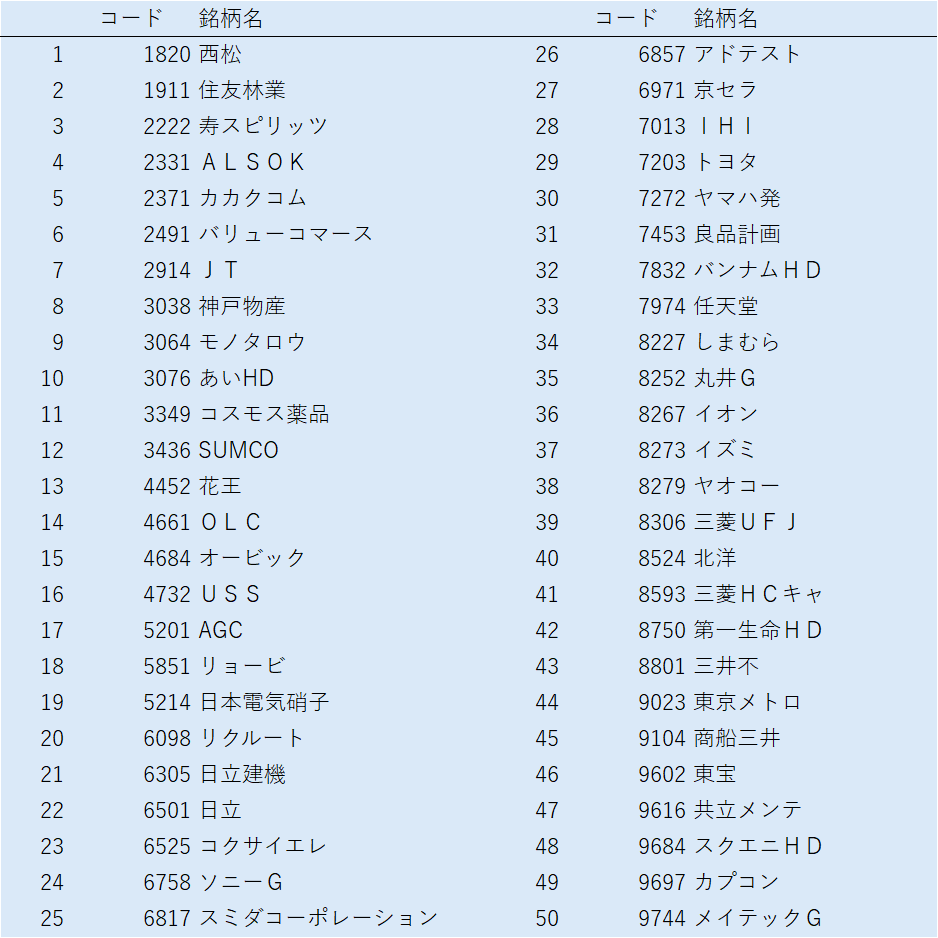

Table 3: June Strategy Portfolio and Stock List