Linea Airdrop Countdown: When L2s Start Feeding Back to L1

With Ethereum’s strong rally, excitement around the impending Linea airdrop is growing rapidly among users.

Linea, a zkEVM Rollup incubated by Consensys, released a “Linea is Ethereum” manifesto ahead of its TGE, unveiling the protocol’s tokenomics and several Ethereum-first decisions. This move isn’t just hype; it represents a paradigm shift in how Layer 2 solutions can drive value back to Layer 1.

Linea clearly states that its entire architecture—including gas mechanics, tokenomics, and governance—is built to return value to the Ethereum mainnet.

Linea is out to prove that Layer 2s should not only scale Ethereum, but also amplify its long-term value.

Ethereum-First

1. ETH is the exclusive gas payment on the Linea network.

2. ETH Deflation and LINEA Value Capture

For each transaction, 20% of the net gas fees paid in ETH (after subtracting L1 costs) will be burned. The remaining 80% is used to buy and burn LINEA tokens, creating two simultaneous deflationary curves. This design establishes a direct economic link between network usage and the value accumulation of both ETH and LINEA. In Linea’s architecture, ETH is more than just a gas token—it’s a yield-generating, deflationary cornerstone asset. At the same time, burning LINEA further reinforces its deflationary nature.

3. Native ETH Staking—Enhanced Capital Efficiency

When users bridge ETH to Linea, it’s automatically staked and earns staking rewards, which are distributed to LPs, powering Linea’s DeFi ecosystem. Linea LPs accrue native yield on top of the standard DeFi returns in the network.

LINEA Token Utility and Tokenomics

LINEA Token Utility

- LINEA is not a gas token.

- LINEA currently has no on-chain governance rights, and the protocol operates without a DAO. According to Linea, this governance framework avoids the pitfalls of token-based voting while still enabling credible, collaborative ecosystem oversight.

- 80% of the net ETH revenue on the Linea network (after L1 costs) is used to buy and burn LINEA.

- LINEA funds builders, users, liquidity providers, and public goods for Ethereum.

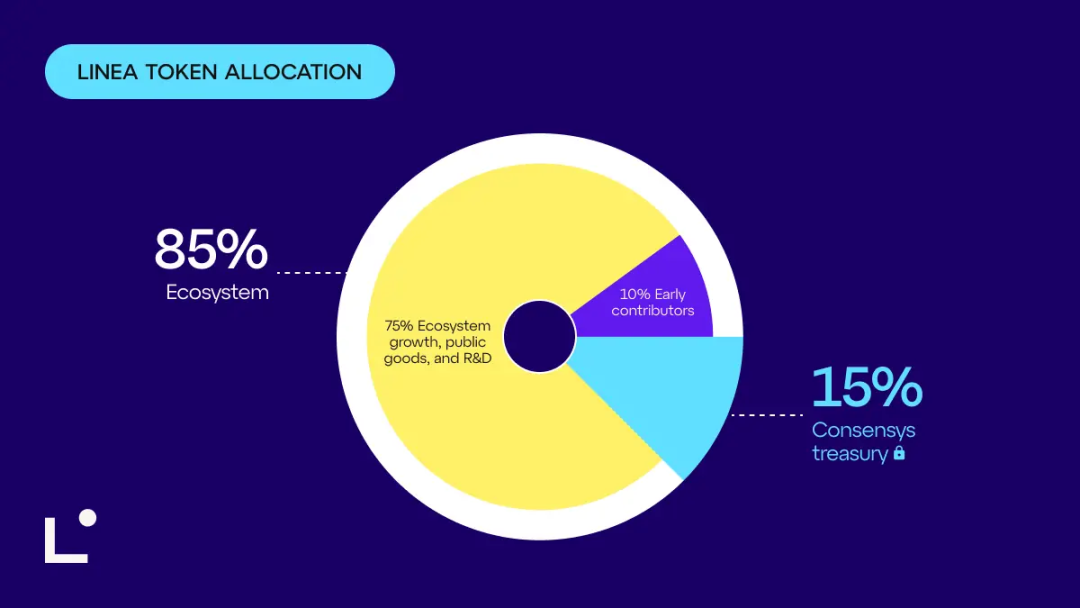

Tokenomics: 85% Allocated to the Ecosystem

The total supply of LINEA is 72,009,990,000 tokens—1,000 times the initial ETH circulating supply.

85% of the LINEA supply is reserved for the ecosystem: 10% goes to early users (9%) and contributors (1%), while 75% is managed by the Linea Consortium via an Ethereum Ecosystem Fund for ecosystem growth, public goods, and Ethereum R&D. The remaining 15% is held by Consensys and fully locked for five years; during the lockup, these tokens may be deployed within the ecosystem as liquidity or for staking. No LINEA tokens have been allocated or sold to employees or investors.

The 9% for early users will be airdropped and fully unlocked at TGE. The snapshot and Sybil filtering are already complete. Airdrop eligibility is determined by a set of activity-based metrics, including LXP and on-chain analytics, aimed at rewarding authentic usage and meaningful participation.

At TGE, about 22% of the total supply (15.8 billion LINEA) enters circulation. This includes airdrops for early contributors, ecosystem activation plans, and liquidity provision. All other token categories remain locked or vest over time.

Establishing the Linea Consortium: Putting the Ecosystem Fund in the Hands of Ethereum Experts

The Linea Consortium is a committee formed by several Ethereum-native organizations. Initial members are Consensys, Eigen Labs, ENS, Status, and Sharplink Gaming. The consortium manages the majority of LINEA’s token allocations. More members are expected to join in the future. Ethereum builders and community members will receive direct support to create public goods, build transformative applications, conduct R&D, and strengthen the protocol stack.

The ecosystem fund is established under a US-based, non-stock entity applying for nonprofit status.

Part of the fund is earmarked for short-term ecosystem bootstrapping—liquidity provision, exchange readiness, strategic partnerships, future airdrops, and early builder incentives. The bulk supports long-term ecosystem development and public goods for Ethereum. Funds are released over a 10-year declining schedule—more at the start to accelerate adoption, gradually decreasing for sustainability.

Roughly 25% of the fund will bootstrap the ecosystem in the first 12-18 months; the remaining 50% vests over a decade. The use of funds includes protocol R&D, shared infrastructure, open-source tools, and strategic partnerships with aligned developers.

Why Is Linea’s Return of Value to L1 So Significant?

Historically, L2s were often seen as “vampires” draining value from L1. Linea flips the script with a dual-deflation engine, native staking bridge, and an ecosystem-driven model:

- ETH isn’t just for gas—it is a direct beneficiary of L2 network revenue;

- On Linea, ETH becomes a core yield asset with enhanced deflationary properties. Liquidity stays on L2, but value consistently flows back to L1 via burning and staking;

- Community funds support public goods, aligning long-term R&D and short-term incentives.

Linea’s ETH burning and auto-staking mechanisms directly boost ETH’s deflation and productivity, ensuring Layer 2 is a positive economic cycle for Ethereum, not a value drain.

Additionally, allocating 85% of tokens to community and ecosystem—higher than most L2s—demonstrates a commitment to decentralized governance and sustainable growth.

While other L2s focus on TPS, Linea brings the spotlight back to ETH itself. For users awaiting the airdrop, this offers not just potential upside, but a vote for Ethereum’s legitimacy.

Linea’s edge lies in being more than a technical scaling solution—it seeks to channel L2 success back into Ethereum through thoughtful economic design. As L2 offerings become more similar, this Ethereum-first philosophy could be a crucial differentiator.

Notably, the Linea Consortium’s initial members include Consensys, the Ethereum Name Service (ENS), restaking pioneer EigenLayer, Ethereum treasury firm Sharplink Gaming (holding 438,200 ETH), and wallet/messaging/L2 infra provider Status (holding 18,100 ETH).

This sets the stage for significant ETH liquidity from Sharplink Gaming, and potentially other Ethereum treasury firms, to flow into Linea—many in the community speculate much of this may end up on Etherex.

Leaning on Consensys’s resources and reputation, Linea could serve as a bridge between traditional finance and Ethereum DeFi, accelerating mass adoption. With MetaMask (100M+ MAUs) and Infura (used by banks) in its toolkit, Linea enjoys unique advantages. Linea reports being trusted by global giants including Mastercard, Visa, JPMorgan, and sovereign banks, and is integrated with leading DeFi protocols, custodians, and tokenization platforms.

According to DefiLlama, Linea’s cross-chain TVL is about $500 million, and DeFi TVL stands at approximately $160 million. This is well below mature L2s—major adoption still lies ahead.

The outcome of this experiment could redefine how the market views L2s: not just as transaction processors, but as value amplifiers for Ethereum. If the model succeeds, it could become the blueprint for future L2s and fuel Ethereum’s long-term prosperity.

Disclaimer:

- This article is republished from [Foresight News], with rights belonging to the original author [KarenZ, Foresight News]. For republication inquiries, please contact the Gate Learn team, and we will address your request promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not represent investment advice.

- Other language versions of this article have been translated by the Gate Learn team. Unless Gate is referenced, no translated content may be copied, distributed, or plagiarized.