BlockchainFoodie

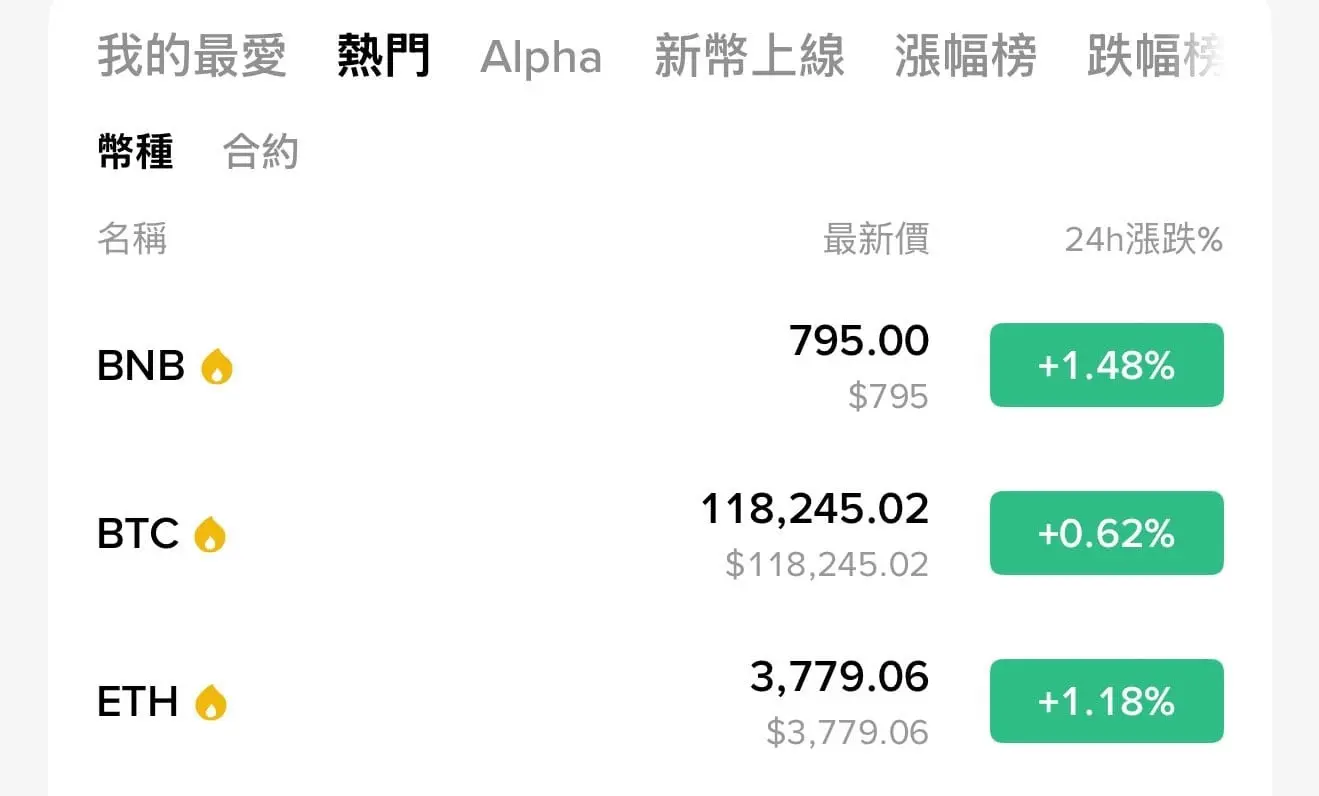

As the price of Ethereum (ETH) continues to rise, the crypto assets market has once again become the focus. However, surprisingly, many investors do not feel excited about this. This unusual phenomenon reflects the complex ecosystem of the current crypto assets market.

Most retail investors seem to hold underperforming small tokens rather than mainstream Crypto Assets. These small tokens often cannot follow the rise of mainstream coins like Ether, causing investors to miss out on this pump.

It is worth noting that the operational strategies of some exchanges may be unfavorable to retail invest

Most retail investors seem to hold underperforming small tokens rather than mainstream Crypto Assets. These small tokens often cannot follow the rise of mainstream coins like Ether, causing investors to miss out on this pump.

It is worth noting that the operational strategies of some exchanges may be unfavorable to retail invest

ETH2.15%